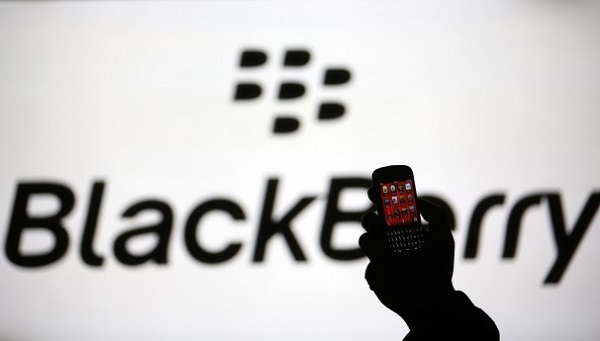

With recent losses of nearly $1 billion and with 40% of its workforce cut, BlackBerry are looking to cut costs by taking themselves off of the stock exchange.

If one was to comprise a list of the current popular smartphones that are available on the market, undoubtedly, the top two brands would be Apple and Samsung, with their respective iPhone and Galaxy lines coming out on top in terms of public opinion as well as in sales. Microsoft’s Windows 8 phones, which, while being significantly less popular, yet still able to hold their own, might even get a mention. The brand that would likely be left in the dust, would be BlackBerry, somewhat of an old relic from the time when people needed dedicated phones to send business emails and when pagers were still cool. Needless to say, the company’s success has been waning for some time now, so, in an effort to stop the rot, BlackBerry are taking themselves off of the stock market.

The news that BlackBerry are choosing to delist themselves has been expected for a while now, as recently, the company announced that they would be cutting around 40% of their global workforce with 4,500 jobs set to be lost. They also reported Q2 losses of approximately $965 million (£600 million) as poor phone sales are to blame. However, it’s not all bad news for shareholders in the company as, agreed in a deal with Fairfax Financial Holdings, which values the Canada-based company at $4.7 billion, shareholders are set to receive $9 per share, almost an entire dollar more than the $8.23 that these shares are currently trading at.

While Fairfax believe that there’s still a future for the ailing mobile phone company, with Fairfax CEO Prem Watsa saying that “We can deliver immediate value to shareholders, while we continue the execution of a long-term strategy in a private company with a focus on delivering superior and secure enterprise solutions to BlackBerry customers around the world.”, their recent launch of the BlackBerry Z10, an all-touchscreen phone, that they hoped to rival Apple and Samsung, fell far from the mark, with part of BlackBerry’s current losses down to a write-down of unsold handsets.

However, going private could really help BlackBerry turn their fortunes around, with the BlackBerry Z30 just going on sale last week, its 5-inch display and larger battery could prove a hit amongst some, while other rumoured BlackBerry phones, codenamed the “Americano” and “Kopi” might prove successful if launched. In any case BlackBerry also have the chance to explore other options (e.g a buyout) before November 4th) so this certainly spells out “an exciting new private chapter for BlackBerry, its customers, carriers and employees” according to Watsa and it will be interesting to see how the future of the company unfolds.

We’ll keep you posted once we know more.

Read more on walyou, BlackBerry Playbook: The Walyou Review, Blackberry Bold 9030: Review